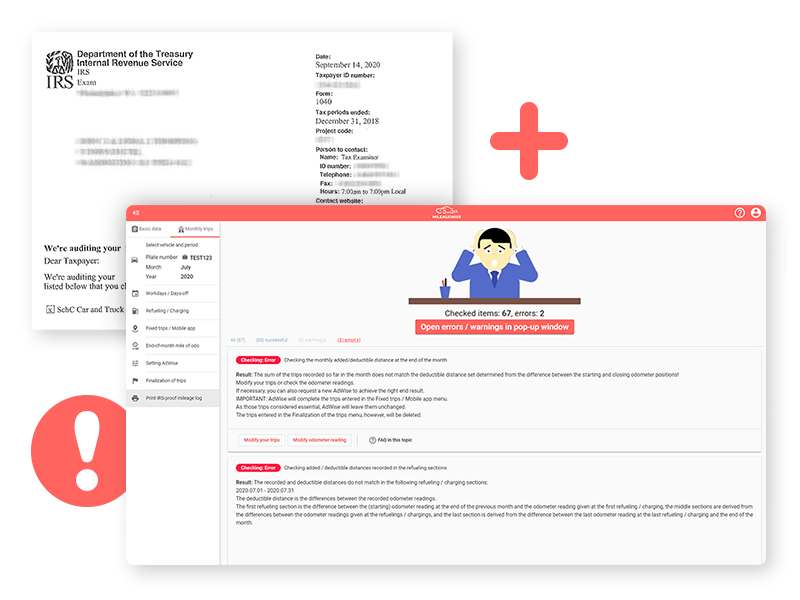

How To Keep a Mileage Log To Claim Vehicle Expenses

A Quick & Easy Guide to Business Mileage Deduction Methods

.png)

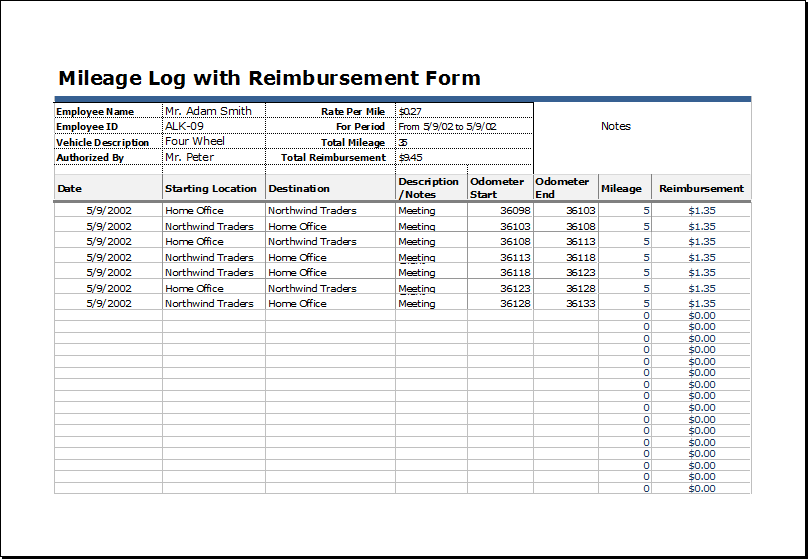

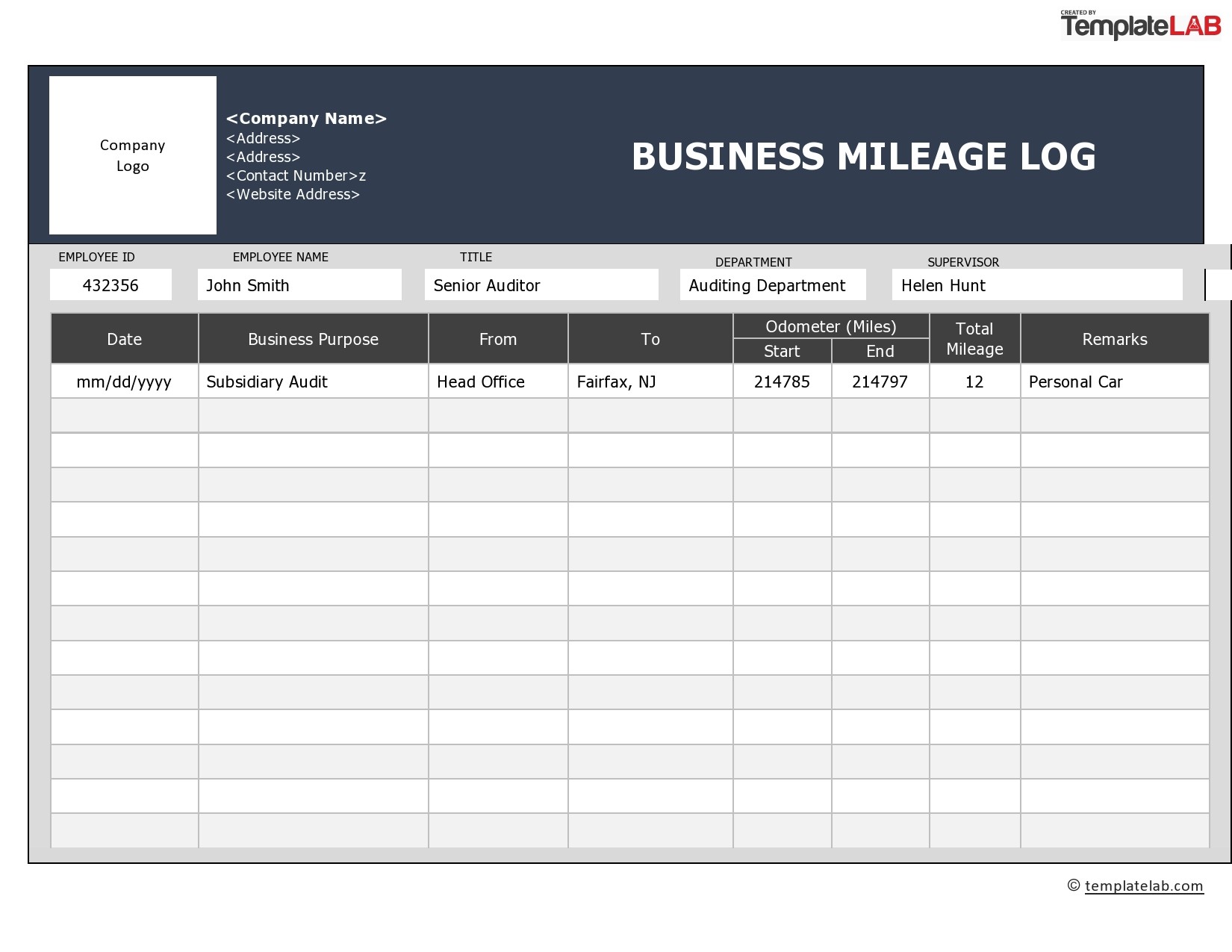

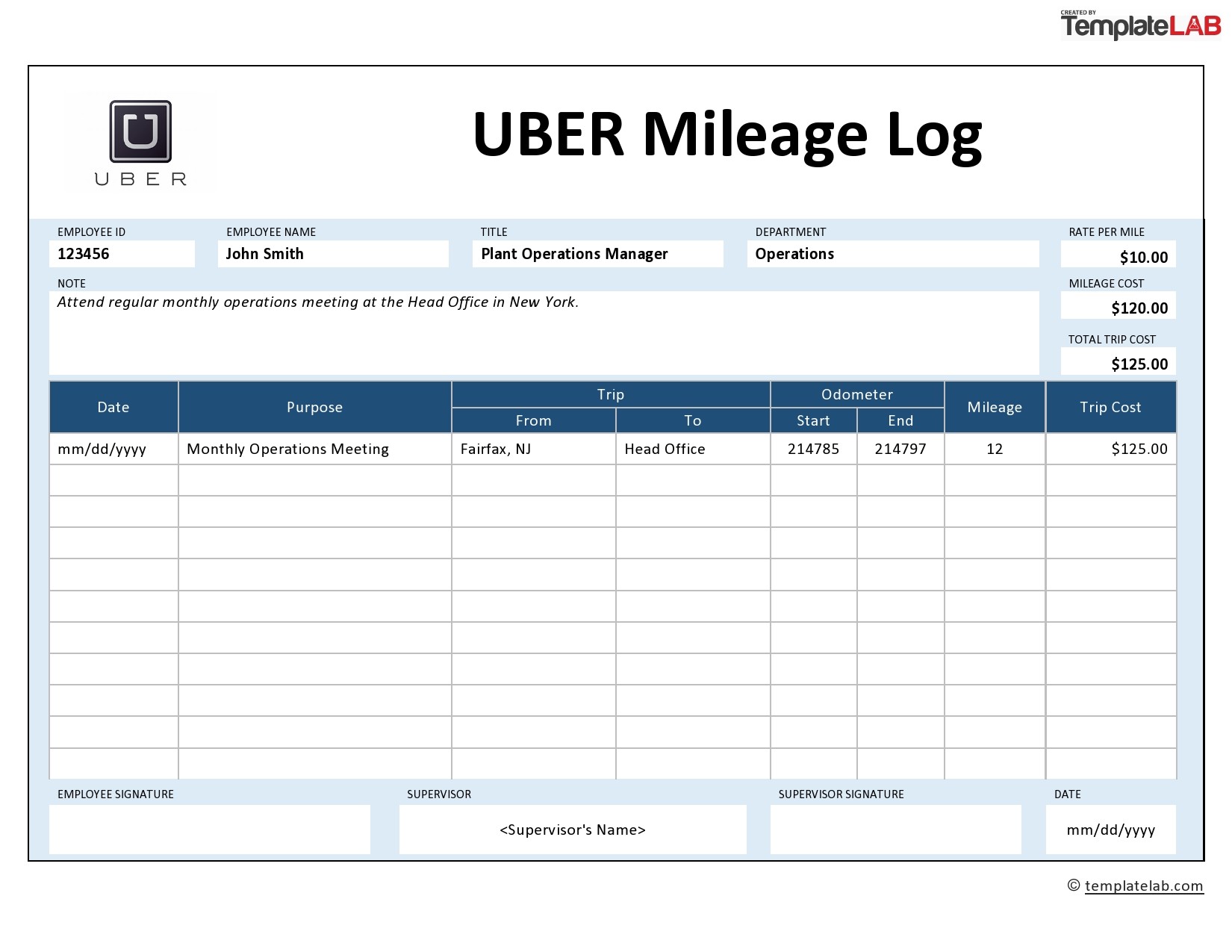

Best Mileage Log Template, Updated for 2023 [Free Template]

How to Keep Track of Mileage for Taxes in 2023

How to keep audit-proof mileage logs that lower your taxes - FBC

Printable Mileage Log - 26+ Examples, Format, Pdf

Free Mileage Log Templates

Standard Mileage vs. Actual Expenses: Getting the Biggest Tax Deduction - TurboTax Tax Tips & Videos

25 Printable IRS Mileage Tracking Templates - GOFAR

:max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg)

How To Keep a Mileage Log To Claim Vehicle Expenses

Do You Need A Mileage Log For A Business-Only Car?

Instructions for Form 2106 (2022)

Free Mileage Log Templates

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

IRS Mileage Rates: Deduct Miles You Drive for Work on Your Taxes

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

How To Keep a Mileage Log To Claim Vehicle Expenses

- Best Price $ 6.50. Good quality and value when compared to simondewaal.eu similar items.

- Seller - 640+ items sold. Top-Rated Plus! Top-Rated Seller, 30-day return policy, ships in 1 business day with tracking.

People Also Loved

-

LOUIS VUITTON Kensington Bowling Damier Ebene Satchel Bag Brown

Buy It Now 7d 16h -

Louis Vuitton Alma BB Pink Epi

Buy It Now 16d 20h -

Louis Vuitton, Bags, Louis Vuitton Epi Cluny Bag

Buy It Now 22d 9h -

Graphic Zipper Knit Top - Ready-to-Wear

Buy It Now 12d 15h -

Louis Vuitton Spell on you, Beauty & Personal Care, Fragrance & Deodorants on Carousell

Buy It Now 20d 18h -

Metal Louis Vuitton Keychain - Creative Repair

Buy It Now 9d 5h -

Louis Vuitton Denim Mini Pleaty

Buy It Now 2d 20h -

Nike x Supreme Shox Ride 2 SP White DN1615-100 Men's Shoes

Buy It Now 2d 23h -

Authentic Louis Vuitton damier hat beanie wool black grey one size made in Italy

Buy It Now 14d 19h -

iPhone 14 Pro review: effortlessly superb

Buy It Now 18d 9h -

Louis Vuitton MONOGRAM VERNIS Félicie pochette (M61267)

Buy It Now 16d 23h -

Louis Vuitton, Bags, Louis Vuitton Geronimos Damier Ebene

Buy It Now 9d 21h -

MICHAEL Michael Kors Jet Set Charm Medium Top Zip Pochette

Buy It Now 9d 13h -

Louis Vuitton Damier Azur Nautical Speedy Bandouliere 25

Buy It Now 6d 6h -

Louıs Vuıtton kadın makyaj çantası

Buy It Now 22d 17h -

GM logo monogram isolated on circle element design template Stock Vector

Buy It Now 9d 22h -

Beautiful BTS Army Keychain for Girls (Combo of 5)

Buy It Now 18d 13h -

Anjou Mini Bag Burgundy/Dark Blue/Grey/Red/Blue/Beige/Black/Light Grey/ Orange/ Brown/ Yellow/Green/White For Women 7.9in/20cm ANJOUSMINCG07TY07P - Clothingta

Buy It Now 15d 5h -

Tory Burch, Bags, Tory Burch Small York Tote

Buy It Now 5d 5h -

Lentes de Sol para Mujer Regalos de Navidad de Lujo

Buy It Now 27d 11h -

Pharrell Williams debuta para Louis Vuitton con estas tendencias

Buy It Now 14d 14h -

A customer asked for instruction on how to make a Louis Vuitton

Buy It Now 13d 13h -

Sample Perfume Oil | Maison Louis Marie No.02 | Le Long Fond

Buy It Now 14d 6h -

Clear Bag Policy - University of Louisville Athletics

Buy It Now 14d 9h